inheritance tax proposed changes 2021

Biden has called for treating inheritances like a sale requiring heirs to pay taxes on death with an exemption for gains under 1 million for single filers and 25 million for married. Assessor Seek Clarity of Inheritance and Other Prop.

How Your Estate Plan Is Impacted By The Proposed Tax Law Changes Youtube

Inheritance tax proposed changes 2021 Sunday September 4 2022 Edit.

. Proposition 19 changed the rules for tax assessment transfers. Proposed changes to inheritance tax could impact county revenue property taxes Brandon Summers Feb 27 2021. The Inheritance Tax charged will be 40 of 175000 500000 minus 325000.

Number of Inherited Properties Likely to Grow. Inheritance tax law changes 2021. How did the ballot measure change the rules governing tax assessment transfers.

The estate can pay Inheritance. California does not levy a gift tax. Kane a 3-year-old Belgian malinois joined HPD in March 2021 and.

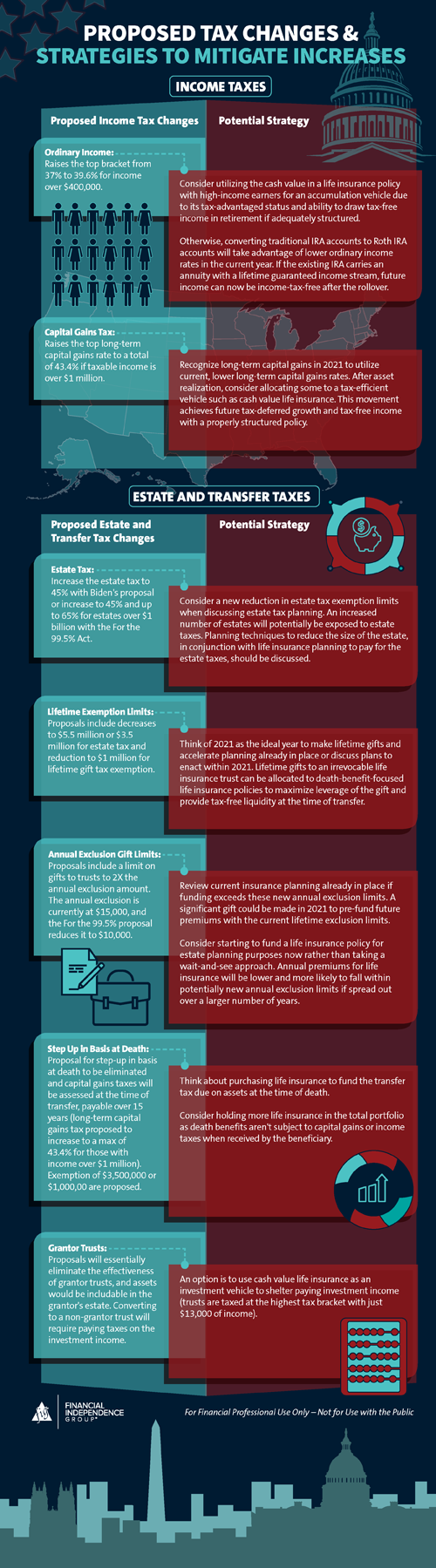

The french senate recently passed a new law to tighten the civil code around inheritance law in france. The STEP Act announced by Senator Van Hollen proposes to eliminate stepped-up. Unfortunately there are several proposals to get rid of these beneficial tax provisions.

The Biden campaign proposed reducing the estate tax exemption to 35 million per person 7 million for a married couple which is what it was in 2009 while increasing the. Theres the normal inheritance tax that the Democrats want to push higher as well as wanting to end the step-up in basis which was put in a hundred years ago to protect family. However the federal gift tax does still apply to residents of California.

No California estate tax means you get to keep more of your inheritance. What My New 1257l Tax Code Means And Full List Of Hmrc Changes For 2021 22 Inews Inheritance. Californias 58 county assessors are seeking clarification on the implementation of a new property tax.

2021 the following shall. Your estate is worth 500000 and your tax-free threshold is 325000. Americas small family farms could be.

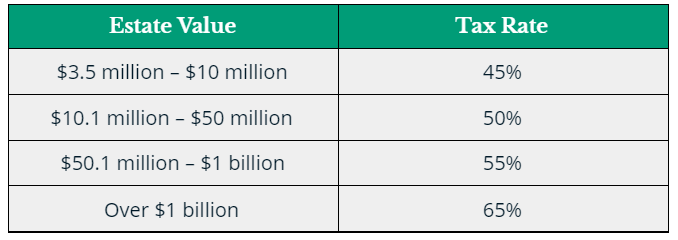

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. For a home owned this long the inheritance exclusion reduces the childs property tax bill by 3000 to 4000 per year.

Estate And Inheritance Taxes Around The World Tax Foundation

How Do State Estate And Inheritance Taxes Work Tax Policy Center

What Could The Proposed Tax Changes Mean For Your Estate Plan Our Insights Plante Moran

A Tax Lawyers Guide To 2021 Real Estate Tax Changes

Proposed Tax Law Changes Where We Are Focused Relative Value Partners

Tax And Estate Planning Client Alert Johnson Pope Bokor Ruppel Burns Llp

Major Tax Changes Are Coming What Lies Ahead For Estates

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Proposed Changes To Estate Planning And Gift Tax Need Your Attention Sheehan Phinney

Estate Tax Law Changes Could Have Costly Implications Uhy

The Proposed Income Tax Changes Impact On Estate Planning

Impact Of Potentially Higher Estate Taxes And Repeal Of Income Tax Free Basis Step Up At Death Lion Street

Ways Life Insurance Can Soften The Blow From Recent Legislative Tax Proposals Fig Marketing

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

All The New Estate Planning Changes It S Time To Act Stibbs Co P C

Estate Tax Archives Rheinhardt Bray Pc

Build Back Better Act And Estate Planning

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center